Dell saw year-on-year revenue decline 10% in the last quarter, with slow sales of PCs continuing to hamper its progress. The vendor has seen an uptick in interest in its server business, with customers eager to get their hands on hardware that can power AI systems. However, its ability to deliver on orders is being hampered by long lead times for components.

Dell’s overall revenue for the three months to the end of October was $22.3bn, compared with $24.7bn for the same period in 2022. The company’s share price fell 4% by the end of trading in the US on Thursday after the results were revealed.

Dell hit hard by PC market slowdown

The company’s declining revenue can largely be pinned on low demand for PCs, with income from its clients’ solutions group – which covers the company’s consumer and enterprise PC business – down almost 11%, to $12.28bn.

This reflects a wider trend of businesses and consumers shunning hardware purchases following the end of Covid-19 pandemic restrictions, a period that saw demand for PCs going through the roof as companies adjusted to widespread remote working.

Analyst house IDC’s latest worldwide personal computing device tracker research, which covers the three months to the end of September, shows that Dell’s PC sales were down 14% in that period. Most other major vendors in the market also saw their sales decline.

The company has been keen to exploit new markets, particularly in cloud computing through its Apex platform, and in the last quarter has penned deals with Microsoft Azure and IBM's Red Hat to boost hybrid cloud integration.

AI to the rescue for Dell?

But it is the company's server business that delivered a rare bright spot for Dell's shareholders, with servers and networking revenue up 9% in the preceding quarter. Overall, its infrastructure business unit saw revenue decline 12%, but the company's executives believe continuing growing demand for AI products and services will aid its return to growth.

Earlier this year, Dell teamed up with Nvidia to launch a range of products optimised for AI workloads. One of its servers, the PowerEdge XE9680, which can feature up to eight Nvidia H100 GPUs, has become "the fastest ramping solution in Dell history" according to COO Jeff Clarke. Speaking to investors on Dell's earnings call, Clarke said: "Our AI-optimised server backlog nearly doubled versus the end of Q2 with a multibillion-dollar sales pipeline, including increasing interest, across all regions." He said that "AI hype is everywhere, and we need to be measured in our expectations", but added that Dell was "excited about the opportunity in front of it".

Content from our partners

AI is transforming efficiencies and unlocking value for distributors

Collaboration along the entire F&B supply chain can optimise and enhance business

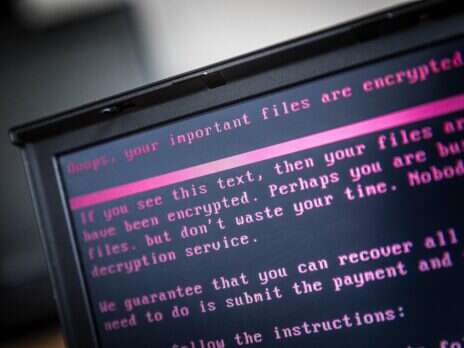

Inside ransomware’s hidden costs

However, Clarke also warned that customers are facing 39-week lead times for these servers, caused by delays in shipping of Nvidia GPUs. As reported by Tech Monitor, Nvidia has been inundated with orders for its AI chips, and issues with the production process at TSMC, the Taiwanese manufacturing giant that builds the GPUs, have caused a backlog in orders that is likely to persist through 2024.

View all newsletters Sign up to our newsletters Data, insights and analysis delivered to you By The Tech Monitor team

Clarke said: "Lead times remain 39 weeks, demand is ahead of supply. We continue to work to improve supply, and we're working now to convert that pipeline into real sales... so we can continue to ship and benefit from this exciting time."

With other semiconductor vendors such as AMD developing their own AI chips which are increasingly competitive with Nvidia's hardware, Clarke said his company could look at other options, but that this was unlikely to solve its supply problems in the short term. He said there are "clearly alternatives coming" to Nvidia, but warned: "There's work to be done in those alternatives, software stacks have to be taken care of, [to] resolve the opportunities around them. But there are more options coming."

Read more: Dell is still hedging its bets on cloud vs on-premise

Topics in this article : Dell